- Advocacy

- Education

- Chapters

- Membership

- FORUM

- Find an Advisor

- About Us

Continuing Education for CLU® Credential Holders

Continuing Education for CLU® Credential Holders

In order to ensure that the knowledge, ability and practice behaviours necessary for financial professionals share a common competency and align with our education requirements, The Institute for Advanced Financial Education (your credentialing body) regularly reviews the education programs associated with our credentials.

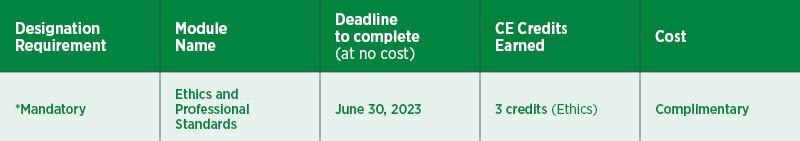

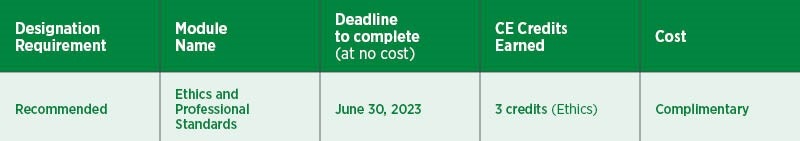

The CLU® curriculum and its Continuing Education (CE) requirements have been revised to reflect this standard. A mandatory CE module has been created by Advocis to satisfy this one-time requirement.

If you earned your CLU designation prior to December 31, 2021, you did not have the opportunity to incorporate the curriculum additions into your learning.

As a CLU designation holder, you will be able to register for this module at no cost. Once completed you will earn 3 CE credits (3 of which are ethics credits).

- Ethics and Professional Standards: Learn more and Register Here

The module is comprised of three case studies, takes approximately three hours to complete and is accredited for three CE credits.

If you have any questions regarding the newly introduced titling framework for Financial Planners and Financial Advisors in Ontario, please consult the FSRA website.

For questions about the new CE module mentioned above, please send us an email at CE@advocis.ca.

If you earned your designation before December 31, 2021 and conduct business in Ontario:

*All CLU designation holders operating in Ontario must complete the required CE module by December 31, 2023 in order to remain in good standing.

If you earned your designation before December 31, 2021 but do not conduct business in Ontario:

Ethics and Professional Standards (891)

A Code of Professional Conduct is an essential component of professionalism. All professions (doctors, lawyers, dentists, accountants, and financial advisors) are governed according to their code of professional conduct. The financial advisor’s attestation to adhere to their Code of Professional Conduct is essential in establishing and maintaining the public’s recognition of the provision of financial advice as a true profession. Knowing their financial advisor abides by a code of professional conduct instils confidence in consumers, regulators and the financial services industry. It also sends the message that Advocis and Institute members are principled. Most importantly, it says that members have instituted the practice to place client interests first in all they do.

- Appreciate the reasons for abiding by a Code of Professional Conduct

- Understand the value of a Code of Professional Conduct for the Financial Planner/Advisor and the Consumer

- Explain how the Institute for Advanced Financial Education enforces the Code of Professional Conduct

- Possess knowledge of the rules and procedures for enforcement of the Code of Professional Conduct

- Follow the best practices for abiding by the eight principles within the Code of Professional Conduct

- Incorporate the principles of the Code of Professional Conduct into your financial planning / advisory practice

Overview

Format: Online learning & quiz Pre-requisites: None CE Credits: 3 CE, all 3 of which is are Ethics credits Note: Please check with your jurisdiction, designating body or professional association regarding their CE requirements. Additional Material: None Completion Requirements:- Passing mark is 60%

- Completion of one online quiz (100% of overall mark)

- Unlimited quiz attempts

- 120 day window for completion

- Self-study: The Advocis online modules are designed as self-study, with success highly dependent on the student’s personal discipline. Students are presented with learning content and a quiz to assess their overall understanding.

Price

Members: Complimentary Non-members: Complimentary Administrative Policies:- All purchases are non-refundable

- There are no cancellations or extensions

- Allow for 1-2 business days to access the module following the registration and payment process