- Advocacy

- Education

- Chapters

- Membership

- FORUM

- Find an Advisor

- About Us

Canadian Institute of Certified Executor Advisors (CICEA)

Canadian Institute of Certified Executor Advisors (CICEA)

Advocis is proud to partner with the Canadian Institute of Certified Executor Advisors (CICEA) to bring advisors the CEA® designation program, the first and only executor-facing designation in Canada. The CEA is an on-line curriculum designed to provide advisors with a practical level of knowledge covering all the issues executors may face in the course of their duties. Advisors learn how to engage with executors; the most trusted and influential people, with legal responsibilities for effective estate settlements.

Testimonials

“It’s been helpful in so many ways… This is just one more step in helping my clients. The course itself is of great value. It’s always updated and I use it all the time.”

— Donald Couse, CFP, CLU, CHFC, EPC, CEA

“This course was leaps and bounds easier to understand than my previous education agenda – I particularly appreciated the encouragement on the last line of the intro – “Have fun”

— Susan Lawrence, CEA

“The Certified Executor Advisor (CEA) designation offered by the CICEA, is an in depth and invaluable program for any professional working with Executors or Testators. Professionals working in this sphere need to be adequately trained and educated and the CEA fits the bill.”

— Scot Dalton, CEA, CEO of ERAssure Executor Liability Insurance

Certified Executor Advisor (CEA®) Designation

CEA® Eligibility

After successful completion of the online exam, CEAs must be members in good standing with the Canadian Institute of Certified Executor Advisors, and adhere to its Code of Conduct and Terms and Conditions, which includes completing 15 hours of continuing education (CE) each year starting in their second year of membership. Continuing education should be in the areas of executor issues, estate planning and federal and provincial legislative changes.

Learning Objectives

Overview

Features

Delivery

Price

Learning Objectives

To be able to engage with Canadian executors to raise their awareness of the risks, roles and responsibilities involved in being an executor / executrix / estate trustee / liquidator.

CEAs do not act as executors but rather as advisors to appointed executors in order to guide them away from problems and toward the professional expertise their situation requires. Intestacy is one of our great challenges and executors, the most trusted and influential people in their testator parents’ lives, are ideally positioned to ensure these and other problems are resolved before it’s too late.

Overview

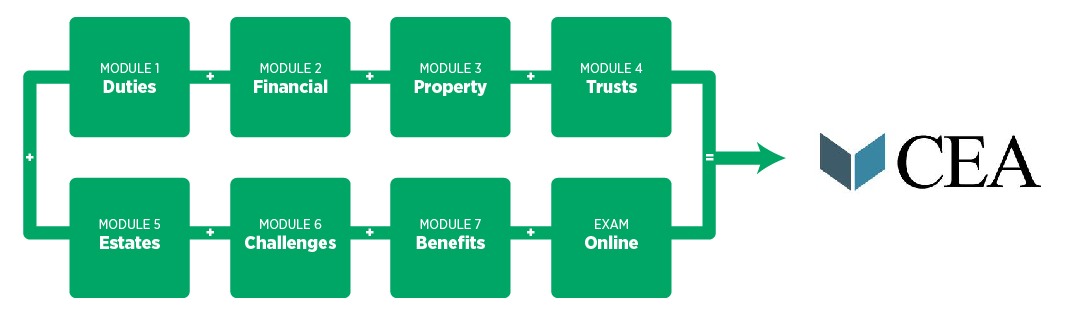

Format: Online learning and exam

Pre-requisites: None

CE Credits: Approved for 30 with Advocis (IAFE), FP Canada, IIROC, AIC (Alberta), CSF (Québec) and recommended by CPA Canada, 16 with IQPF (Québec), 8 with Mortgage Professionals Canada and ICM (Manitoba). Credits are pending with RIBO and other organizations.

Additional Material: None

Completion Requirements:

- Passing mark is 70%

- Exam is 100% of evaluation requirements

Features

- State of the art learning platform followed by an online exam

- Unlimited access to the constantly updated CEA curriculum

- Exam attempts – 2

- Access to 1,000+ term Glossary

- Access to tools and resources, including proprietary executor–focused calculators

- Professional listing on the national Find A CEA Directory

- Regular news updates

- Optional membership in 2016 to attend regional CICEA chapter meetings

Delivery

Self-study: This is designed as a self-study course, with success highly dependent on the student’s personal discipline.

Access: Candidates can access the learning platform from any electronic device at anytime, anywhere internet connectivity is available.

Price

NOTE: The CEA designation was certified and now qualifies for refundable tax credits with the Canada Training Credit and the Ontario Jobs Training Tax Credit. For more information please contact info@cicea.ca.

CEA designation program: Non-members: $1,495 plus taxes, Members: $1,295 plus taxes

Renewal fees:General members: $295 plus taxes, Chapter members: $495 (Optional) plus taxes

General membership includes ongoing access to the updated curriculum, the 1,000+ term glossary, tools, resources and proprietary executor-focused calculators and a professional listing on the national Find A CEA directory.

Chapter membership includes all of the benefits of general membership plus being a member of the CICEA regional chapters which will hold meetings for social and business networking with the 17 CEA professions and provide expert speakers on executor issues.

Included with your registration is your first year of membership. Renewal fees will be processed the following year from the date of registration.

Who Should Enrol?

Any one of the seventeen professions executors may turn to in the course of their duties, particularly including:

- Financial Advisors concerned with the imminent erosion of AUA caused by death, or those wanting to build their assets under administration and expand their client bases, and/or those involved in practice succession wanting to bring in a new generation of clients to align with the new generation of advisors

- Insurance Advisors wanting to engage executors prior to the death of their testator parents to review liquidity issues arising on death (capital gains, deemed dispositions, recaptured depreciation, etc.) and estate planning opportunities (business succession, charitable gift structures, equalization, etc.)

Prerequisites

There are no pre-requisites for the CEA designation program, because candidates may come from numerous diverse backgrounds such as accounting, law, charitable giving, and as a result, no presumptions have been made as to knowledge of any one particular competence.

This course introduces the fundamentals of financial planning, and looks at concepts and applications associated with financial calculations and financial statement analysis. Contracting and family law basics are covered followed by a review of government-sponsored benefit programs.